Fareportal and Synchrony Financial to Launch Co-Branded Travel Rewards Credit Card Program

Next generation online travel agency announces consumer financing options and enhanced loyalty program benefits for CheapOair and OneTravel with new credit cards

NEW YORK, September 27, 2016: Fareportal, a high-tech, high-touch travel company that powers a next generation travel concierge, is set to launch a co-branded credit card program with Synchrony Financial (NYSE: SYF) in October 2016. The program includes new Visa® and Visa Signature® credit cards for both CheapOair and OneTravel, as well as a private label credit card for each brand.

Designed to enhance the existing CheapOair and OneTravel Rewards programs and help customers accelerate earnings, the cards will offer a range of introductory offers to qualifying cardholders1 including:

- Access to special financing for six months on qualifying purchases of $399 or more (after discounts).

- A $50 statement credit after making purchases of $500 or more in the first 90 days (excludes special financing purchases).

- Accelerated earning of CheapOair and OneTravel Rewards Program Points.

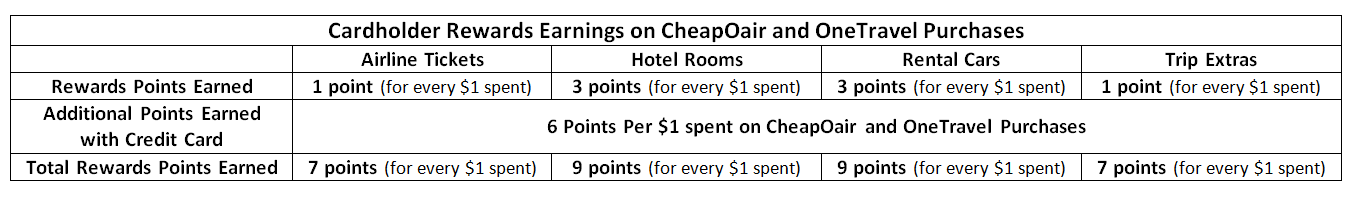

Cardholders get CheapOair and OneTravel Reward’s Program Points plus 6 additional Points per $1 spent using their CheapOair or OneTravel Credit Card on CheapOair.com and OneTravel.com. The chart below outlines what a cardholder could earn in rewards points:

In addition to earning points faster on all CheapOair and OneTravel purchases, Visa credit cardholders will earn 4 points for every $1 spent on dining purchases and 2 points for every $1 spent on all other purchases wherever Visa credit cards are accepted.

CheapOair and OneTravel operate with a business model that bridges the gap between an online travel agency and a traditional travel agency by providing convenient online booking capabilities, as well as a 24/7 personalized trip booking experience.

“Travelers are looking for great experiences and also for cheap flights,” said Michael Culhane, CFO of Fareportal. “Our new relationship with Synchrony Financial offers our customers outstanding financing options and an enhanced loyalty program. Additionally, a co-brand card will allow our customers to use their card anywhere in the world to earn rewards.”

Fareportal is among the first travel companies to offer its customers special financing options through a co-branded credit card program. A recent survey conducted by Synchrony Financial found that 72% of travelers said they would be “very” or “extremely” likely to apply for and open a travel credit card, and utilize special financing, if their travel purchase was more than $399.2

Travelers around the world can find and book their perfect trip on CheapOair or OneTravel’s websites, mobile and tablet apps, and by calling one of thousands of trained travel agents in multiple countries and in multiple languages. Fareportal provides access to more than 450 airlines, 200,000 hotels and hundreds of car agencies worldwide.

“Synchrony Financial shares Fareportal’s passion for using innovation and technology to provide a seamless customer service experience,” said Tom Quindlen, executive vice president and CEO, Retail Card, Synchrony Financial. “Special financing can be a key differentiator for travelers looking for flexible payment options while also maximizing the versatility and value of expenditures with a Fareportal credit card.”

1 Subject to credit approval

2Crowdtap survey, August 2016

About Fareportal

Fareportal is a high-tech, high-touch Travel Company that powers the next generation travel concierge. Utilizing its innovative technology and company owned and operated contact centers; Fareportal has forged strong industry partnerships providing access to over 450 airlines, 200,000 hotels, and hundreds of car rental companies that serve millions of customers every year. To learn more, visit http://www.fareportal.com/.

About Synchrony Financial

Synchrony Financial (NYSE: SYF) is one of the nation’s premier consumer financial services companies. Our roots in consumer finance trace back to 1932, and today we are the largest provider of private label credit cards in the United States based on purchase volume and receivables.* We provide a range of credit products through programs we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers to help generate growth for our partners and offer financial flexibility to our customers. Through our partners’ over 350,000 locations across the United States and Canada, and their websites and mobile applications, we offer our customers a variety of credit products to finance the purchase of goods and services. Synchrony Financial offers private label and co-branded Dual Card™ credit cards, promotional financing and installment lending, loyalty programs and FDIC-insured savings products through Synchrony Bank. More information can be found at www.synchronyfinancial.com, facebook.com/SynchronyFinancial, www.linkedin.com/company/synchrony-financial and twitter.com/SYFNews.

*Source: The Nilson Report (May 2016, Issue # 1087) – based on 2015 data.

Leave a Reply

Want to join the discussion?Feel free to contribute!